- 16 Şubat 2021

- -

- mopa

- -

- Forex Trading

- -

- harami candlestick: How to Use Bullish and Bearish Harami Candles to Find Trend Reversals için yorumlar kapalı

Contents:

Japanese candlestick charts are the default feature on most popular crypto exchanges. You can replace them with bars or other types of charts, though. Like many other crypto trading interface elements, candlestick charts came from stock markets. The chart above of the Gold ETF shows an excellent example of the harami cross at a bottom. The chart illustrates a four day dramatic move downward, with a very large bearish candlestick on the fourth day. The large bearish candlestick established an area of support at its closing price that was confirmed weeks and months later.

The harami cross means that the trend reversal is about to hit. If you spot the harami pattern at the end of the downward chart line, it is a bullish harami signal. The second candle opens at a significantly higher position than the previous candle.

What Is a Harami Candlestick Pattern?

Commodity.com is not liable for any damages arising out of the use of its contents. When evaluating online brokers, always consult the broker’s website. Commodity.com makes no warranty that its content will be accurate, timely, useful, or reliable.

Which candlestick pattern is most reliable?

According to the book Encyclopedia of Candlestick Charts by Thomas Bulkowski, the Evening Star Candlestick is one of the most reliable of the candlestick indicators. It is a bearish reversal pattern occurring at the top of an uptrend that has a 72% chance of accurately predicting a downtrend.

Some benefits of the harami cross strategy include attractive entry levels for investments as the trends potentially reverse upwards. The movement is more straightforward to spot for beginner traders than many alternatives, providing a more attractive risk-reward ratio for many of its users. The Harami candlestick pattern is highly recognizable on your charts. However, like all price patterns, trading the Harami alone is not a good idea. This is especially true when you’re looking for trend reversals.

Bulkowski on the Bearish Harami Candle Pattern

If you already see a green candle, the best moment to buy an asset is behind. However, some traders buy at this point expecting the continuation of the bull run. Trading candlesticks like the bullish harami needs strict discipline and emotion-free trading. Candlestick trading is a part of technical analysis and success rate may vary depending upon the type of stock selected and the overall market conditions. Use of proper stop-loss, profit level and capital management is advised.

Nifty Forms Bullish Harami Candlestick Pattern, Further Short … – Investing.com India

Nifty Forms Bullish Harami Candlestick Pattern, Further Short ….

Posted: Tue, 02 Mar 2021 08:00:00 GMT [source]

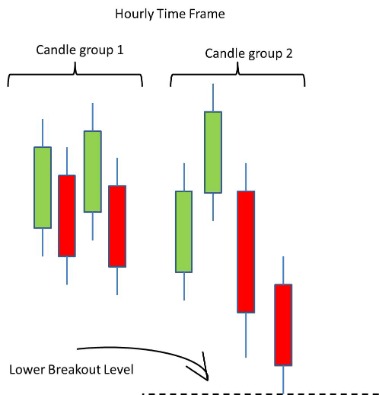

The bullish harami is a two candlestick chart pattern that appears at the end of a downward trend and signals that the current is about to reverse. One of the harami pattern variations is called the “harami cross.” It occurs when the second candle appears to be entirely empty. The level of this “cross” continues the trend presented by previous candles. The candle with wicks but without the body signals the drastic market activity drop.

How to Use Bullish and Bearish Harami Candles to Find Trend Reversals

DTTW™ is proud to be the lead sponsor of TraderTV.LIVE™, the fastest-growing day trading channel on YouTube. What IS important is the location of the Harami within an existing trend and the direction of that trend. The second candle must be contained within the first candle’s body . It can be either color, and it will have a smaller body. Only the body needs to be contained within the first candle; the wicks are irrelevant. Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position.

“Best” means the highest rated of the four combinations of bull/bear market, up/down breakouts. The TC2000 bullish harami scan is a powerful reversal pattern that returns stocks popping higher after a sharp sell off. The TC2000 bearish harami scan is a powerful reversal pattern that returns stocks dropping lower after a sharp rally. It can be used in combination with other technical indicators to confirm a potential reversal. We recommend backtesting all your trading ideas – including candlestick patterns.

The first bar of the Harami candlestick pattern represents an exhaustive move. It is an unsustainable thrust in the direction of the trend. Others perceive the harami candle as an indecision sign and prefer to halt their trades until new candles show up and make the trend direction clearer.

The bullish harami indicator is charted as a long candlestick followed by a smaller body, referred to as a doji, that is completely contained within the vertical range of the previous body. To some, a line drawn around this pattern resembles a pregnant woman. The word harami comes from an old Japanese word meaning pregnant. Finally, it is crucial to use other analyses and indicators alongside the hamari cross pattern.

However, other techniques can be used simultaneously to determine the optimal exit strategy. Certain techniques can aid the harami cross pattern and hopefully reduce the risk-reward of the investment. Since the bullish harami is a trend reversal pattern, you want to confirm the reversal with another momentum indicator. The MACD and RSI are two of the most important momentum indicators that you can use when identifying the bullish harami pattern. One of the main advantages of the harami candlestick pattern is that it’s easy to identify. This pattern has somewhat clear and distinctive elements that make harami easily recognizable.

What is a Marubozu Candlestick?

A Marubozu Candlestick pattern is a candlestick that has no “wicks” (no upper or lower shadow line). A green Marubozu candle occurs when the open price equals the low price and the closing price equals the high price and is considered very bullish. A red Marubozu candle indicates that sellers controlled the price from the opening bell to the close of the day so it is considered very bearish.

In contrast, the bullish harami pattern begins in the downtrend with a large red candlestick followed by a little green one. The name “Harami” comes from Japanese and means pregnant due to the fact that the formation is similar in appearance to a pregnant woman. There are two types of Harami candle patterns, the bullish and bearish harami candlestick pattern. A bullish harami candle pattern is formed at the lower end of a downtrend. P1 is a long red candle, and P2 is a small blue candle.

- A deeper analysis provides insight using more advanced candlestick patterns, including island reversal, hook reversal, and san-ku or three gaps patterns.

- Below, you can see how to identify the harami pattern on a trading chart.

- When you spot a Harami candlestick pattern, the key here is to use the moving average to set an entry point.

- Please note all of the subsequent examples are on a 5-minute time frame, but the rules apply to other time frames just as well.

- On day 1 of the pattern , a red candle with a new low is formed, reinforcing the bear’s position in the market.

A bullish Harami occurs at the bottom of a downtrend when there is a large bearish red candle on Day 1 followed by a smaller bearish or bullish candle on Day 2. The first black arrow shows an increase of IBM and price interaction with the upper bollinger band. On that token, the next price increase confirms the double bottom pattern and the price closes outside of the downtrend channel, which has held the price down the entire trading day. At this point, the writing is on the wall and we exit our short position. The Harami candlestick pattern is usually considered more of a secondary candlestick pattern. These are not as powerful as the formations we went over in our Candlestick Patterns Explained article; nonetheless, they are important when reading price and volume action.

Many traders see the occurrence of harami candles as a point of uncertainty rather than a clear bullish, or bearish signal. Traders consider it but wait for the following developments instead of performing immediate trades. The TC2000 bearish harami scan will return to you stocks that fit the essence of this classic candlestick reversal pattern definition. While some may want to trade the strategy in a down-trending market, it is not a good idea. The strategy is best suited for trading the reversal of pullbacks in an uptrend after the price has retraced to a support level.

Understanding a Candlestick Chart – Trading – Investopedia

Understanding a Candlestick Chart – Trading.

Posted: Fri, 11 May 2018 13:40:01 GMT [source]

The further decrease in price then creates a bottom, marked with a green line. Then, we see a resistance level develop – the blue line. These are our next support and resistance levels for Facebook. Within the orange lines, you will see a consolidation, which looks like a bearish pennant.

https://g-markets.net/ Cross ExampleAs you can see, this was a perfect harami cross setup. But the important point was the fact that we saw other candlestick formations confirm what the harami cross was telling us. The risk-taker will initiate the trade on day 2, near the closing price of 125. The risk-averse will initiate the trade on the day after P2, only after ensuring it forms a red candle day. In the above example, the risk-averse would have avoided the trade completely. If both these conditions are satisfied, one can conclude that both P1 and P2 form a bullish harami pattern.

The harami candlestick pattern is one of many popular indicators used with candlestick charts. The significance of a harami pattern is illustrated next. During a downtrend a long bearish candlestick emerges, which reinforces that the bears are still in charge. Nevertheless, on the second day, rather than heading lower, which a trader would expect if the bears were still in charge, the price gaps higher.

What is a Marubozu Candlestick?

A Marubozu Candlestick pattern is a candlestick that has no “wicks” (no upper or lower shadow line). A green Marubozu candle occurs when the open price equals the low price and the closing price equals the high price and is considered very bullish. A red Marubozu candle indicates that sellers controlled the price from the opening bell to the close of the day so it is considered very bearish.